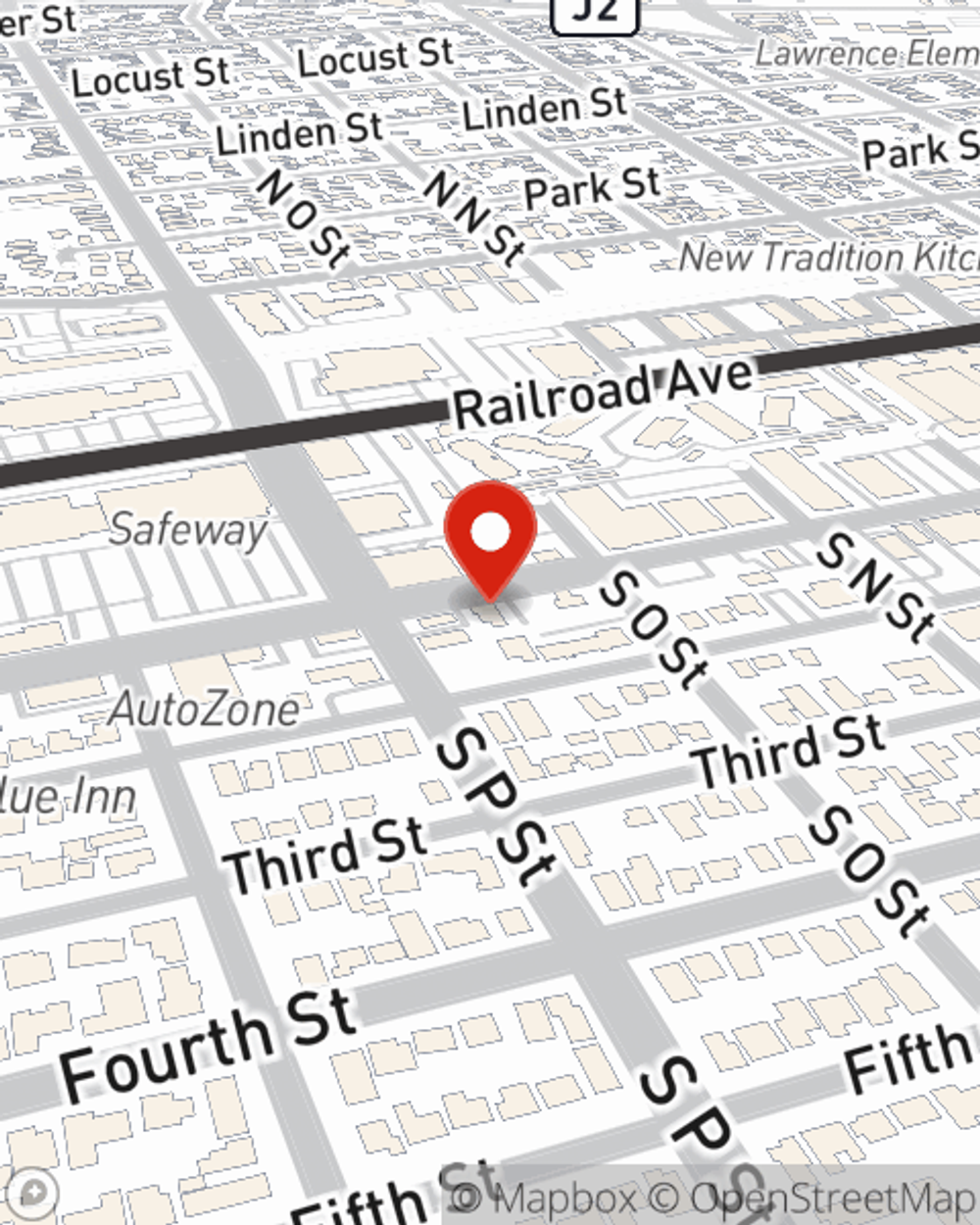

Business Insurance in and around Livermore

Looking for small business insurance coverage?

Cover all the bases for your small business

Insure The Business You've Built.

Running a small business comes with a unique set of wins and losses. You shouldn't have to deal with those alone. Aside from just those who care for you, let State Farm be part of your line of support through insurance options including errors and omissions liability, worker's compensation for your employees and business continuity plans, among others.

Looking for small business insurance coverage?

Cover all the bases for your small business

Keep Your Business Secure

Whether you own a photography business, a home cleaning service or a clock shop, State Farm is here to help. Aside from outstanding service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Get right down to business by visiting agent Cathy Pasut's team to explore your options.

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Cathy Pasut

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.